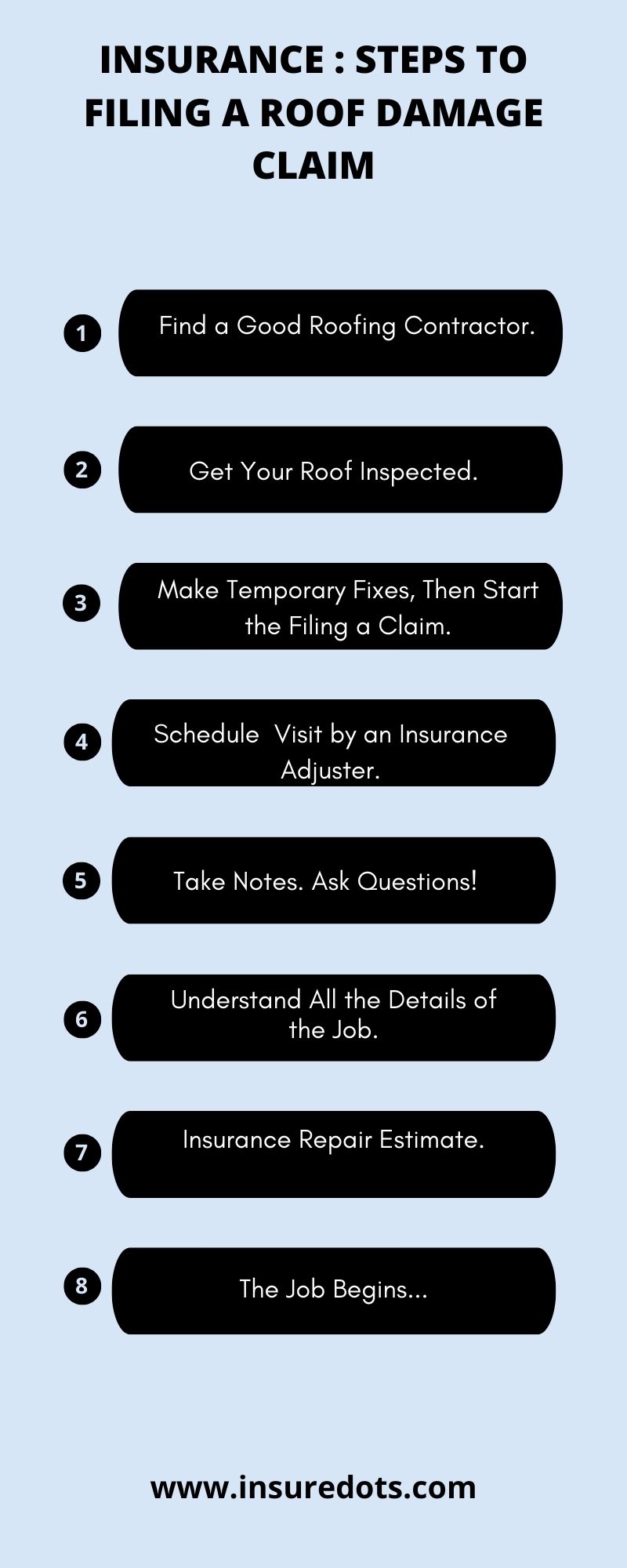

Insurance: Steps to Filing a Roof Damage Claim.

Your Guide for Roof Insurance Claims

Are you facing roof damage and unsure how to proceed? Filing a roof damage claim with your insurance company can help you get the necessary financial support for repairs or replacements. Here’s a step-by-step guide to help you through the process:

Step 1: Document the Damage

Take clear and detailed pictures of the roof damage to provide evidence of the extent of the harm. These visuals will support your claim and enable the insurance adjuster to assess the situation accurately.

Step 2: Contact Your Insurance Company

Inform your insurance company about the damage and initiate the claims process. They will guide you through the necessary steps and provide you with the required forms to fill out.

Step 3: Understand Your Policy

Review your insurance policy carefully to determine the coverage you have for roof damages. Pay attention to deductibles, limits, and any exclusions that may affect your claim.

Step 4: File the Claim

Fill out the claim forms provided by your insurance company accurately and with all the necessary details. Be sure to include the documentation and pictures of the roof damage to support your case.

Step 5: Keep Records

Maintain copies of all correspondence with your insurance company, including emails, letters, and claim numbers. It is crucial to have a record of all communication and documents for reference.

By following these steps, you can navigate the insurance claim process smoothly and increase the likelihood of a successful roof damage claim. Remember, each insurance company may have specific requirements, so it’s essential to consult with them directly and seek professional advice if needed.

The Importance of Roof Insurance Claims

When it comes to protecting your home, having insurance is essential. One area of your home that is particularly vulnerable to damage is the roof. Whether it’s due to a storm, a fallen tree, or normal wear and tear, roof damage can be expensive to repair.

That’s why filing a roof insurance claim is so important. By following the necessary steps, you can ensure that your insurance company covers the cost of repairs, saving you from having to pay out of pocket.

Here are the key steps to filing a roof insurance claim:

- Assess the damage: Before filing a claim, it’s important to assess the damage to your roof. Take photos and document any visible signs of damage.

- Contact your insurance company: Once you’ve assessed the damage, contact your insurance company to start the claims process. They will guide you through the necessary steps and provide you with the required forms.

- Provide documentation: Your insurance company will likely require documentation of the damage, such as photos, estimates from contractors, and any other relevant information. Gather all the necessary paperwork to support your claim.

- Meet with an adjuster: Your insurance company will send an adjuster to assess the damage and determine the coverage. Be present during the inspection to ensure all damages are properly documented.

- Review the settlement: Once the adjuster has assessed the damage, the insurance company will provide you with a settlement offer. Review the offer carefully and make sure it covers all the necessary repairs.

- Repair your roof: If you’re satisfied with the settlement offer, hire a reputable roofing contractor to repair your roof. Keep records of all the repairs and payments made.

Filing a roof insurance claim can be a complex process, but it’s worth the effort. By following these steps and working closely with your insurance company, you can ensure that you get the coverage you deserve and restore your roof to its former condition.

Remember, your roof is an essential part of your home’s structure and protecting it with insurance is crucial. Don’t overlook the importance of roof insurance claims.

Assessing the Damage

When it comes to filing a roof damage claim, one of the most important steps is assessing the damage. This step is crucial in order to determine the extent of the damage and to provide accurate information to your insurance company.

To assess the damage to your roof, you will need to inspect it carefully. Look for any signs of obvious damage, such as missing or broken shingles, leaks, or sagging. Take note of any areas that seem particularly damaged or vulnerable.

It is also important to document the damage by taking photos or videos. This will provide visual evidence of the extent of the damage and can be used as supporting documentation for your claim.

If you are not comfortable inspecting your roof yourself, you can hire a professional roofing contractor to do the assessment for you. They have the knowledge and experience to identify all types of damage and can provide you with a detailed report.

Once you have assessed the damage, it is time to file your claim with your insurance company. Make sure to include all the relevant information, such as the date and time of the damage, a description of what happened, and any supporting documentation you have gathered.

Remember, the more detailed and accurate your assessment of the damage is, the smoother the claims process will be. Take the time to thoroughly inspect your roof and gather all the necessary information before filing your claim.

Inspecting Your Roof

Inspecting your roof is an important step in the process of filing a roof damage claim with your insurance company. It is crucial to thoroughly assess the condition of your roof to accurately determine the extent of the damage and ensure that all necessary repairs are accounted for in your claim.

Here are some steps to follow when inspecting your roof:

- Start with a visual inspection: Carefully examine your roof for any visible signs of damage, such as missing or damaged shingles, loose or curling shingles, or signs of leaking. Take note of any areas that require immediate attention.

- Check for water stains: Look for water stains on your ceiling or walls, as this could indicate a leak in your roof. Pay close attention to areas near chimneys, vents, or skylights.

- Inspect the attic: Go into your attic and look for any signs of water damage, such as wet insulation or mold growth. This can help identify areas where your roof may be leaking.

- Document the damage: Take photos or videos of the damage to provide visual evidence for your insurance claim. Make sure to capture close-up shots as well as wider angles to show the overall condition of your roof.

- Consider hiring a professional: If you are unsure about the extent of the damage or need assistance with the inspection, it may be beneficial to hire a professional roofing contractor. They can provide a detailed assessment and help ensure that nothing is overlooked.

Remember, the more thorough and detailed your inspection, the better chance you have of accurately filing your roof damage claim with your insurance company. Take the time to carefully evaluate the condition of your roof before proceeding with the claims process.

Documenting the Damage

When filing a roof damage claim, it is important to thoroughly document the extent of the damage. This documentation will be crucial in ensuring a successful claim and receiving the compensation you deserve.

Here are the steps to properly document the damage:

- Inspect the Roof: Carefully examine your roof to identify any visible damages. Look for missing or broken shingles, signs of leaks, or any other visible signs of damage.

- Take Photos: Use a camera or smartphone to take clear and detailed photos of the damage. Make sure to capture different angles and close-ups of the affected areas. This visual evidence will strengthen your claim.

- Take Notes: Write down any important details about the damage, such as the date and time it occurred, the location on the roof, and other relevant information. This will help you provide accurate information to your insurance company.

- Collect Supporting Documents: Gather any additional documents that can support your claim. This may include previous roof inspection reports, maintenance records, or invoices for repairs and replacements.

- Get Professional Help: Consider hiring a professional roofing contractor to assess the damage and provide an estimate for repairs. This expert opinion will carry weight with your insurance company and strengthen your claim.

Remember, the more detailed and comprehensive your documentation is, the better chance you have of successfully filing your roof damage claim. Don’t overlook any step in the process, and don’t hesitate to reach out to professionals for assistance.

Taking Photographs

One of the most crucial steps in filing an insurance claim for roof damage is taking photographs. These photographs will serve as evidence of the damages and will help support your claim. Here are some important tips to follow:

- Document the damage: Take clear and detailed photographs of the roof damage from various angles. Capture both close-up shots and wider shots to provide a comprehensive view of the extent of the damage.

- Include surrounding areas: In addition to the roof, photograph any nearby structures or objects that have been affected by the damage. This will help establish the cause and extent of the damage.

- Take before and after photos: If possible, locate any old photos of your undamaged roof. This will provide a useful reference point for the insurance adjuster to compare the pre-damage condition with the current state.

- Use a quality camera: To ensure clear and detailed images, use a good-quality digital camera or smartphone. Avoid blurry or grainy shots, as they may not clearly show the damages.

Note: Always prioritize safety when taking photographs. If it is unsafe to access the roof or the damaged area, do not attempt to do so. Instead, take pictures from a safe vantage point or hire a professional roofer or inspector to document the damage.

By following these steps and taking thorough photographs, you can provide strong evidence to support your claim and increase the chances of a successful roof insurance claim. Remember to consult with your insurance provider to ensure you follow their specific requirements for documenting roof damage.

Contacting Your Insurance Company

If your roof has sustained damage and you believe it is covered by your insurance policy, the first step in the claims process is to contact your insurance company. Here are the steps to follow:

- 1. Locate your policy information: Before contacting your insurance company, make sure you have your policy number and any other relevant information readily available.

- 2. Call your insurance company: Use the contact information provided in your policy documentation to call your insurance company’s claims department. Inform them that you need to file a roof damage claim.

- 3. Provide necessary information: During the call, you will be asked to provide details about the damage, such as when it occurred, the cause of the damage, and any other relevant information. Be prepared to answer these questions accurately.

- 4. Schedule an inspection: After providing the initial information, the insurance company will typically assign an adjuster to inspect your roof and assess the damage. Schedule a convenient time for the inspection.

- 5. Document the damage: Before the adjuster arrives, take photos and videos of the damaged areas of your roof, both from up close and from a distance, if possible. This documentation will help support your claim.

- 6. Meet with the adjuster: On the scheduled date, meet the adjuster at your property to discuss the damage and show them the documented evidence. Answer any additional questions they may have.

- 7. Review the adjuster’s report: Once the adjuster has completed their assessment, they will provide you with a report detailing the damage and the estimated cost of repairs. Review this report carefully to ensure all necessary repairs are included.

- 8. Proceed with repairs: If you agree with the adjuster’s report, you can proceed with getting the repairs done. Keep all receipts and documentation related to the repairs for your records.

- 9. Follow up with the insurance company: After the repairs are completed, follow up with your insurance company to provide them with any necessary documentation and ensure the claim is processed promptly.

- 10. Receive compensation: Once your claim has been processed and approved, you will receive compensation from your insurance company to cover the cost of the repairs, minus any deductible stated in your policy.

Remember, each insurance company may have slightly different procedures for filing a roof damage claim, so it’s important to follow their specific instructions and guidelines. Contacting your insurance company as soon as possible after discovering the damage will help expedite the claims process and ensure a smoother experience.

Notifying Your Insurance Provider

When you discover roof damage, it is crucial to notify your insurance provider as soon as possible. Filing a claim for roof damage can be a complex and time-consuming process, so it is important to start the process promptly.

Here are the steps you should follow when notifying your insurance provider:

- Contact your insurance company’s claims department as soon as possible. Be prepared to provide details about the damage, including the date and cause.

- Take photographs of the damage to include with your claim. These photos will help document the extent of the damage and can support your case.

- Make temporary repairs to prevent further damage. Your insurance company may require you to take reasonable steps to mitigate the damage and protect your property.

- Keep track of all communication with your insurance company. This includes written correspondence, phone calls, and in-person meetings. Having a record of these conversations can be helpful if any issues arise during the claims process.

- Provide any necessary documentation to support your claim. This may include repair estimates, receipts for temporary repairs, and any other relevant records.

- Stay organized and keep all paperwork related to your claim in a safe place. This will make it easier to provide any requested information and keep track of the progress of your claim.

By following these steps and promptly notifying your insurance provider, you can ensure that the filing process goes smoothly and increase your chances of receiving a fair settlement for your roof damage.

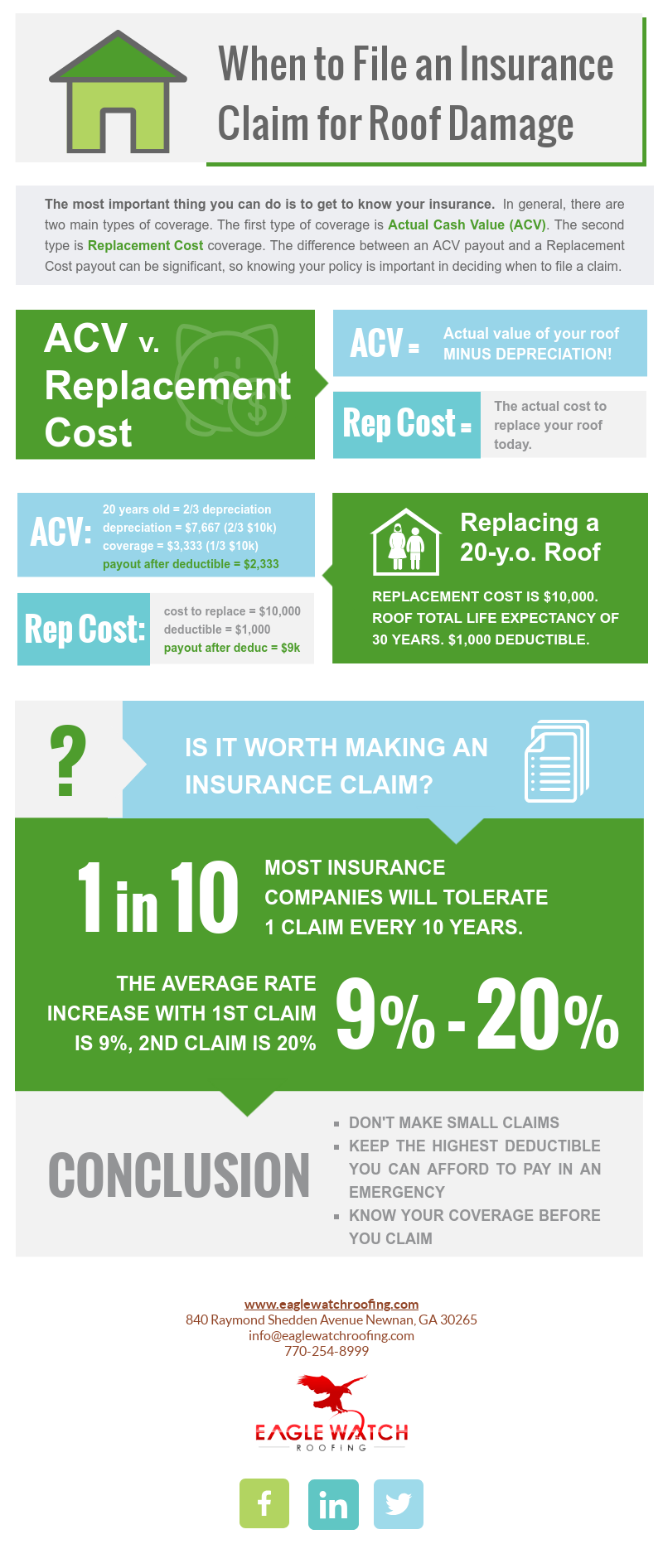

Understanding Your Policy

When it comes to filing a roof damage claim, it is crucial to have a clear understanding of your insurance policy. This will help you navigate the steps involved in the claim process and ensure that you receive the compensation you deserve.

Here are some important points to consider when reviewing your policy:

- Coverage: Check what types of roof damage are covered under your policy. This may include storm damage, fire damage, vandalism, and more.

- Deductible: Know the amount of your deductible, which is the amount you are responsible for paying out of pocket before your insurance coverage kicks in.

- Claim filing process: Familiarize yourself with the steps involved in filing a roof damage claim. This may include contacting your insurance company, providing documentation of the damage, and getting estimates for repairs.

- Claims adjuster: Understand that your insurance company may send a claims adjuster to assess the damage and determine the amount of compensation you are eligible for.

- Exclusions: Take note of any exclusions in your policy, such as pre-existing damage, wear and tear, or inadequate maintenance.

By understanding your policy, you can ensure that you follow the necessary steps when filing a roof damage claim. This will help expedite the process and increase your chances of receiving fair compensation for the damage.

Reviewing Coverage Details

Before filing a roof damage claim with your insurance company, it’s essential to review your coverage details. These steps will help ensure a smooth and successful claim filing process:

- Step 1: Gather all pertinent documents, including your insurance policy, any endorsements, and any recent correspondence with your insurance company.

- Step 2: Familiarize yourself with the terms and conditions of your policy. Pay close attention to the section covering roof damage and the specific requirements for filing a claim.

- Step 3: Determine the extent of the damage to your roof. Assess whether the damage is covered under your policy, as some types of damage may be excluded.

- Step 4: Take detailed photographs of the damage. These will serve as evidence when filing your claim.

- Step 5: Contact your insurance company to notify them of the damage and to initiate the claim process. Have your policy number and any relevant information ready.

- Step 6: Provide your insurance company with all necessary documentation, including photographs, a detailed description of the damage, and any estimates for repairs or replacement.

- Step 7: Keep a record of all communication with your insurance company, including dates, names of representatives, and details of discussions or agreements.

- Step 8: Follow up with your insurance company regularly to check on the progress of your claim and provide any additional information or documentation if requested.

- Step 9: Review your insurance company’s response to your claim and any settlement offer. If you disagree with their decision or the settlement amount, you may need to negotiate or appeal the decision.

By carefully reviewing your coverage details and following these steps, you can increase your chances of a successful roof damage claim filing with your insurance company.

Filing the Claim

When your roof sustains damage, it’s important to file an insurance claim as soon as possible to ensure that you receive the necessary coverage for repairs or replacement. Follow these steps to complete the filing process:

- Contact your insurance provider to report the roof damage. Have your policy number and any relevant information available.

- Provide a detailed description of the damage, including when it occurred and any contributing factors such as severe weather or falling debris.

- Take photos or videos of the damaged areas. These visual records will help support your claim.

- Obtain estimates from reputable roofing contractors for the cost of repairs or replacement. Keep all documentation, including receipts and invoices.

- Submit your claim form along with the supporting documents to your insurance provider.

- Review your policy to understand the coverage and deductible for roof damage. This will help you determine your out-of-pocket expenses and what your insurance company will cover.

- File any necessary paperwork, such as a proof of loss form, if required by your insurance provider.

- Keep records of all communication with your insurance company and any adjusters assigned to your case.

- Follow up on your claim regularly to ensure it is being processed in a timely manner.

- Once your claim is approved, schedule the repairs or replacement with a licensed roofing contractor.

Remember that filing a roof damage claim can be a complex process, so it’s always helpful to consult with a professional who specializes in insurance claims to guide you through the process and maximize your coverage.

Submitting the Necessary Paperwork

When filing a roof insurance claim, it’s important to follow the proper steps and submit all the necessary paperwork. This will help ensure that your claim is processed smoothly and that you receive the compensation you deserve for the damage to your roof.

Step 1: Notify your insurance company

As soon as you discover roof damage, contact your insurance company to report the incident. This should be done promptly to avoid any delays in the claims process.

Step 2: Gather evidence

Document the damage to your roof by taking photographs or videos. This visual evidence will help support your claim and prove the extent of the damage.

Step 3: Collect necessary documents

Gather all relevant paperwork, including your insurance policy, the inspection report, repair estimates, and any other supporting documentation. These documents will be required when submitting your claim.

Step 4: Complete claim forms

Fill out all the required claim forms provided by your insurance company. Double-check that you have included all the necessary details to avoid any delays or rejections.

Step 5: Submit your claim

Submit your completed claim forms and supporting documents to your insurance company. Make sure to keep copies of everything for your records.

Step 6: Follow up

After submitting your claim, it’s important to follow up with your insurance company to ensure that the process is moving forward. Keep track of any communication and document all conversations.

Step 7: Review the settlement

Once your insurance company has reviewed your claim, they will provide you with a settlement offer. Carefully review the offer and consult with a professional if needed to ensure that you are receiving fair compensation for the roof damage.

Step 8: Complete repairs

If your claim is approved, schedule the necessary repairs for your roof. Make sure to keep all receipts and documentation related to the repairs, as these may be required for reimbursement.

By following these steps and submitting all the necessary paperwork, you can increase your chances of a successful roof insurance claim. Remember to review your insurance policy to understand your coverage and contact your insurance company for any specific instructions or requirements.

Working with an Adjuster

When filing a roof damage claim with your insurance company, you will likely need to work with an adjuster. An adjuster is an insurance professional who assesses the damage and determines the amount of coverage you are eligible for. Here are the steps to follow when working with an adjuster:

- Contact your insurance company: Begin by contacting your insurance company to report the damage and start the claims process. They will assign an adjuster to your case.

- Schedule an appointment: Once assigned, the adjuster will reach out to you to schedule an appointment to assess the damage. Make sure to choose a date and time that works best for you.

- Prepare for the inspection: Before the adjuster arrives, take the necessary steps to prepare for the inspection. This may include gathering documentation such as photos of the damage, receipts for repairs, and any other relevant information.

- Show the damage: During the inspection, walk the adjuster through the property and point out the areas of damage. Be sure to provide any evidence and documentation you have gathered.

- Ask questions: Take the opportunity to ask the adjuster any questions you have regarding the claims process, coverage, or any other concerns you may have.

- Receive the estimate: After assessing the damage, the adjuster will provide you with an estimate of the coverage you are eligible for. Review the estimate and make sure it accurately reflects the necessary repairs.

- Negotiate if necessary: If you believe the estimate does not adequately cover the repairs, you have the right to negotiate with the adjuster. Provide any additional evidence or documentation that supports your case.

- Finalize the claim: Once you and the adjuster come to an agreement on the coverage, finalize the claim by signing any necessary paperwork.

Working with an adjuster is an essential step in the roof damage insurance claim process. By following these steps and communicating effectively with the adjuster, you can ensure a smoother and more satisfactory claims experience.

Coordinating an Inspection

After filing your roof damage claim with your insurance company, the next step is to coordinate an inspection. This inspection will help determine the extent of the damage and the necessary repairs or replacements.

Here are the steps to follow when coordinating an inspection for your roof insurance claim:

- Contact your insurance company: Reach out to your insurance company and inform them that you need to schedule an inspection for your roof damage claim. Provide them with all the necessary information, such as your policy number and the date of the incident.

- Document the damage: Before the inspection, take photos and videos of the damage to your roof. This visual evidence will be useful during the inspection process and when discussing the claim with your insurance adjuster.

- Choose a roofing contractor: If your insurance company requires you to select a specific roofing contractor, follow their guidelines. Otherwise, you can choose a reputable contractor on your own. Make sure to get multiple quotes for the repairs or replacement.

- Schedule the inspection: Coordinate a date and time for the inspection with both your insurance company and the roofing contractor. Try to find a time that works for all parties involved.

- Prepare for the inspection: Clear any obstructions around your roof and make sure the roofing contractor has access to the damaged area. Provide the inspector with any relevant information about the incident and the damage that occurred.

- Attend the inspection: It’s important to be present during the inspection. This way, you can ask questions, point out specific areas of concern, and ensure that all the necessary details are documented by the inspector.

- Receive the inspection report: After the inspection, you will receive a report detailing the findings and recommendations. Review this report carefully and make sure it accurately reflects the damage to your roof.

- Submit the report to your insurance company: Send a copy of the inspection report to your insurance company. This report will help support your claim and assist the adjuster in determining the coverage and compensation you are eligible for.

By following these steps and coordinating an inspection for your roof insurance claim, you will ensure a thorough evaluation of the damage and increase your chances of a successful claim outcome.

Getting Multiple Estimates

When filing a roof damage claim, it’s important to obtain multiple estimates from different roofing contractors to ensure you get the best possible deal. Here are the steps you can follow:

- Research roofing contractors in your area that specialize in roof repairs and replacements.

- Contact each contractor and schedule an appointment for them to assess the damage to your roof.

- During the assessment, ask the contractor to provide a detailed written estimate for the cost of repairs or replacement.

- Make sure to get at least three estimates to compare.

By getting multiple estimates, you’ll have a better understanding of the extent of the damage and the cost of repairs or replacement. This will also help you negotiate with your insurance company when filing your roof damage claim.

Remember to choose a contractor who is licensed, insured, and has a good reputation. This will ensure that the repairs or replacement are done correctly and will be covered under your insurance policy.

Obtaining Quotes for Repairs

After experiencing damage to your roof and filing an insurance claim, the next step is to obtain quotes for repairs. It is important to get multiple quotes from reputable contractors to ensure you are getting a fair and accurate estimate for the cost of repairs. Here are some steps you can follow to obtain quotes:

- Research local contractors: Start by researching local contractors who specialize in roof repairs and have experience dealing with insurance claims. Look for contractors who are licensed, insured, and have positive reviews from previous customers.

- Contact contractors: Reach out to multiple contractors and explain the nature of your roof damage and insurance claim. Provide them with any relevant information or documentation they may need to accurately assess the damage.

- Schedule on-site inspections: Arrange for the contractors to visit your property and conduct on-site inspections. This will allow them to assess the full extent of the damage and provide a more accurate quote.

- Request written quotes: After the on-site inspections, request written quotes from each contractor. Make sure the quotes include a detailed breakdown of the costs, including materials, labor, and any additional expenses. This will help you compare and evaluate the quotes.

- Compare quotes: Review and compare the quotes you received. Take into consideration the reputation of the contractors, the quality of materials they plan to use, and any additional services they offer.

- Choose a contractor: Once you have compared the quotes and considered all relevant factors, choose the contractor that best suits your needs and budget. Notify your insurance company of your chosen contractor so they can proceed with the necessary approvals.

Obtaining quotes for repairs is an essential step in the insurance claim process. It helps ensure that you receive fair compensation from your insurance company and that the necessary repairs are completed properly and to your satisfaction.

Negotiating the Settlement

Once you have filed a roof damage claim with your insurance company, the next step is negotiating the settlement. This process can often be complex and time-consuming, but with the right approach, you can maximize your chances of receiving a fair settlement for your roof damage.

Here are some steps to guide you through the negotiation process:

- Evaluate the damage: Before entering into negotiations, it’s important to have a clear understanding of the extent of the damage to your roof. Document the damage with photographs and gather any supporting evidence, such as repair estimates or professional assessments.

- Review your insurance policy: Familiarize yourself with the terms and conditions of your insurance policy, paying particular attention to coverage limits and exclusions. This will help you determine how much you are entitled to claim.

- Present your case: Prepare a strong case to present to the insurance company, highlighting the evidence of the damage and demonstrating that the repairs or replacement are necessary. Be clear and concise in your communication, providing all necessary documentation.

- Negotiate the settlement: Engage in a constructive dialogue with your insurance company’s claims adjuster. Be prepared to negotiate and provide any additional information or documentation they request. It may also be helpful to seek assistance from a public adjuster or roofing professional who can advocate on your behalf.

- Consider mediation or appraisal: If the negotiations reach a stalemate, you may consider alternative dispute resolution methods, such as mediation or appraisal. These processes can help resolve any disagreements and ensure a fair settlement.

- Review and accept the settlement: Once a settlement has been agreed upon, carefully review the terms and conditions before accepting. Ensure that all repairs and replacement costs are adequately covered and that any future damage is accounted for.

Remember, the negotiation process requires patience, persistence, and a thorough understanding of your insurance policy. By following these steps and advocating for your rights, you can increase the likelihood of receiving a satisfactory settlement for your roof damage claim.

Communicating with the Insurance Company

When it comes to filing a roof damage claim with your insurance, effective communication is key. Here are a few steps to help you communicate with your insurance company:

- Document the damage: Before contacting your insurance company, gather all the necessary information and documentation of the damage. This includes taking photos and videos of the roof damage from multiple angles.

- Contact your insurance agent: Reach out to your insurance agent as soon as possible to report the roof damage and initiate the claim process. Provide them with all the details of the damage, including when and how it occurred.

- Provide accurate information: When speaking with your insurance agent, make sure to provide accurate information about the roof damage. Be honest and thorough in describing the extent of the damage, as well as any pre-existing conditions that may have contributed to it.

- Keep records: Keep a record of all communications with your insurance company, including names, phone numbers, and any instructions or promises made. This will help you stay organized and provide evidence in case of any disputes.

- Follow up: Stay in touch with your insurance company throughout the claim process. Follow up on any requested documents or information promptly to avoid delays in the settlement.

Remember, effective communication is crucial in the roof insurance claim process. By providing accurate information and staying organized, you can increase your chances of a successful claim and efficient resolution of your roof damage.

Question-Answer:

What does this guide cover?

This guide covers the steps to filing a roof damage claim and serves as a helpful resource for anyone navigating the insurance claims process.

How can this guide help me with my roof insurance claim?

This guide provides a step-by-step explanation of the insurance claim process for roof damage, including what documents you need, how to document the damage, and how to negotiate with your insurance company.

Will this guide help me understand what my insurance policy covers?

Yes, this guide discusses the importance of reviewing your insurance policy to understand what you are covered for, as well as how to identify roof damage and file a claim accordingly.

Can this guide help me if my roof has sustained hurricane damage?

Yes, this guide includes tips specifically related to roof damage caused by hurricanes, such as the importance of temporary repairs and documenting the damage before permanent repairs are made.

Is this guide suitable for first-time insurance filers?

Yes, this guide is beginner-friendly and provides a comprehensive overview of the steps involved in filing a roof damage insurance claim. It can help first-time filers navigate the process with confidence.

What is this guide about?

This guide is about the steps to filing a roof damage claim with your insurance company.